Haibo showed excellent account and risk management skills in December 2018 and got a $1,000 prize!

Read Haibo's interview and see his account statement -to make your own success story

How long have you been trading?

I entered the FX market in January 2018 so it has been more than a year for me.

How did you get involved in Forex trading?

I engage in administrative management in a large company. The job is relatively stable ,but the salary is not high. I have been working with this company for a very long time and there is not much room for personal growth. As part of my work, I tend to pay close attention and research investment products and technologies, such as Stocks, Funds, Futures, and Foreign Exchange (Forex).

Firstly, let us talk about China A shares. In ten years, GDP growth has been growing exponentially, but the A shares are stagnant. Retail traders suffer great losses in the Stock market, so I always treat the stock market with bearish mentality. Even if there is recovery, it tends to be small. I focus on the Stock market but not trade it. Retail investors could not compete with bankers.

On the other hand, FX is relatively simple and flexible, and you can go long (Buy) or short (Sell). Comparing to the Stock market, the news and technology of FX market is easier to grasp. There are not only the bankers, so you can only depend on candlesticks to trade. So after several rounds of demo trading, I made a careful decision to enter the FX market in January 2018. It was a challenge for me. I chose XAUUSD to trade firstly. The fundamentals and news of US dollar have a greater influence on the gold market which has 80% of the negative relationship with the dollar index. As long as investors pay attention to the development trend of the American economy and some risk factors, and trade with the trend, they basically can grasp the larger move. Trading gold is simple and can be profitable.

What is your trading style?

My trade style is radical. I prefer volatile market, and buy low at support and sell high at resistance. Generally I am an intraday trader, and the proportion of my day trade is about 75%. I think that I can avoid most of riskier moves in this way. But in a trending market, such as the gold rising from 1240 to 1298 during the end of last year because of seasonal factor, my profits were not so big.

At present, I am adapting to the trend trading, trying to do longer-term trades, and learning the excellent experience from solid traders. In general, strategies which meet my criteria and allow for consistent profit are the best.

Do you practice risk management?

When it comes to risk management, it is one of my personal shortcomings. I have had some tough moments because of it. In January 2018 I traded gold and my account doubled within 3 first months, from $6000 to $22000. I was too confident. In March 2018, the trade war between America and China broke out, and the gold rose to 1365 because of risk aversion. In the process of market rally, I opened a short position against trend and blew up my account.

Without conducting a thorough analysis I wanted to continue and deposited $20000 to my account in April. I thought gold would rise because of risk aversion. As a result, as the U.S. stock market hit record highs and gold prices fell to new lows, I blew my account, and I was dispirited and burned. It was June 2018, and I decided to break from trading for three months. By October 2018, I had returned to the market.

Through the recommendation of a friend, I registered with TICKMILL, and my total deposit is $7000. After the previous bad experience I have set following rules to myself:

- Don't take large positions.

- Don't add to a position against the trend

- Place stop loss.

- Don't let losing trades run.

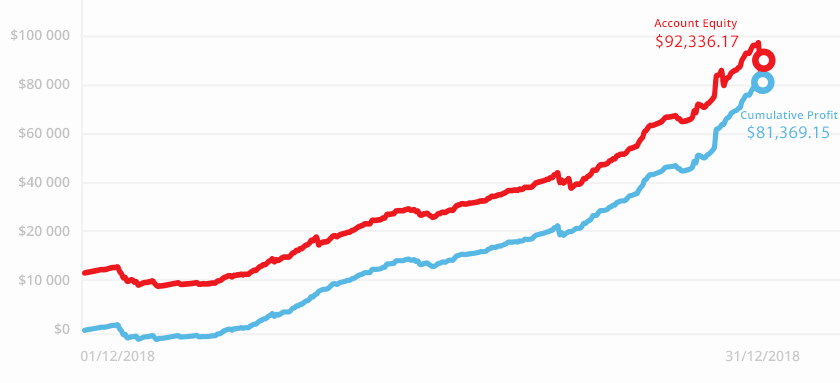

- Based on the principle that risk control shpuld be a priority, my account earnings increased by 1000% within 3 months. Risk management has immediate effect on profits.

What are some good habits smart traders develop?

In my opinion, smart traders should have following habits:

- Market analysis. You should not open positions in a hurry. During the Asian session, you can look at price trends using indicators and understand the news and external markets, such as the U.S. economic situation, recent sensitive events in America, and the dynamic of U.S. stocks/Dow Jones / s&p 500 / A shares.

- For example, the slump of U.S. stocks will cause capital to flow to safe-haven assets in FX market, especially gold(XAU) and yen(JPY). The recent Brexit decision will lead to big swings in GBP pairs. During the European session, you can choose entry properly. If the trend in Asian session continues, you can buy low or sell high. During US session, there are larger fluctuations and more data-based moves. After understanding the trend, you can choose an opportunity to exit the market or enter again. In terms of technology, in the absence of market news, I personally use the combination of trend lines, bollinger bands, pressure lines, support lines and candlesticks of different periods to judge the future trend. In addition, I also use the combination of 30 minutes and 1 hour candlesticks to judge the trend and find the entry.

- Risk control. You should follow the principle of “risk first, income second”. After entering the market, you should set a stop loss and stick to it, and do not let losing trades run. If the trade is profitable, a novice can take profit by closing position, or increase profits using trailing stops.

- The principle of adding to a position. Traders often lose trades through adding to a position. But if the market condition does not reverse, adding to a losing position will lead to taking a large position, and you may blow your account eventually. Only if the trade is profitable, you can build up your position. When the total position is controllable, you can enter the market with 20% in the first time, 30% in second time, and 50% in the third time, that is 2:3:5. Total position should not be over 30%.

- Calm down. You should be neither self-satisfied because of a profit , nor feel bad because of one or two stop losses. Investment is a long-term process, and the aim is to profit overall and protect the capital. Only being calm allows you to make a consistent profit and let the profits run. Secondly, you should maintain self-confidence, eliminate external interference, and do not reference to the strategy of others too much, otherwise you will never grow. Investment is actually very simple, and it comes down to strategy and execution. Act as a lonely trader.

Describe your best/most memorable trade (How much did you profit? What was the strategy? What pair?)

On January 3, 2019 morning, the Japanese yen surged and resulted in a flash crash in FX market. GBPJPY fell to 132 from 137. At that time, I hold 24 lots of long positions at an average of 138. I thought it would drop to 135 at most. But after market opening in the morning,it fell vertically. By that time, the advance payment of my positions was close to the 50%, so I locked 20 lots of short position at an average of 135.945. But because of operation delay, I could not lock position in a real sense, causing my long position stop out at 135. The price fell to new low 132, and my short position profited $56000, because my "masterstroke" saved most of my position. It is a strategy which is the fastest, the most impressive, the most profitable, and the most appropriate on locking a position I’ve seen since I've been in the currency market.

What advice would you give to new traders?

My advice to new investors has been analysed in detail above and can be summed up in the following points:

- analyse the move, do not place trades in a hurry;

- risk control and strict implementation;

- adding to a position gradually, do not heavily invest in a position ;

- keep calm and confident. In addition, several points should be added

- strengthen learning, pay more attention to observe the rules of tools-indicators and the controlled information , learn more technical analysis, such as candlestick , moving average, trend line, etc., and improve the ability of market analysis;

- In terms of intraday trade, the matter is quality, not quantity. If big data-based moves which you can not understand appear , you should wait and see;

- losses do not matter, and we cannot win in every trade. As long as you can profit as a whole and protect the capital, you will earn it back someday.

Considering the current state of the market, what do you think are the news/events traders should keep an eye on?

When there is a news event, such as the federal reserve's speech, Trump’s comments on oil prices,and Brexit ,before the information is released, traders should forecast the price trend that could be affected, analysis the direction of trend that may be caused , and develop a strategy for the move in advance .

When prices rise and fall directly, rise after fall, or fall after rise, investors should be cautious when enter a trade. It is most important to set up stop loss. After the news event, there may be a certain lag effect, and the news move will impact the subsequent price trend, so setting your own strategy and stop loss is the best way to deal with this.

What are the most important things you look for in a Forex broker?

When looking for a FX broker, I pay attention to the following points:

- trade security. It is the foundation of trading, and mainly refers to the qualification and reputation of platform. The selected broker must have regulatory license and good reputation. If the broker was established a short time ago, is not regulated, there are many complaints about service then you can conclude that its operation effect is poor.

- trade quality. What must be mentioned here are the response speed of the platform server, website and order, as well as the speed of deposit & withdrawal. If slippage is large and order cannot be executed when ordinary and big move appear, traders may face losses; Traders, including me, are most concerned about deposit & withdraw. What they want are deposit which is fast and withdraw without worries.

- trade cost. Only when cost and spread are low, you can get more profits in the trend.

- customer service. It is similar to after-sales service. Solving the confusion and problems of traders in time will also increase the awareness of the platform;

- daily promotion activity and competition incentive activity. These are also ways to attract new investors, and I am also interested in this kind of activity.

Finally, thank you to TICKMILL’s platform for giving me the opportunity to show my investment skills. After studying the platform. I found it is regulated, has high safety and good reputation, and has won the popularity of many investors.

During the three months, deposit arrive account in real time, and withdrawals are accepted within 48 hours. Customer service staff respond quickly, and solve some of my daily problems timely through online method and email. Comparing to other platforms, the spread and cost of TICKMILL platform has advantages, which reduce my trade cost. Winning the live trade contest this time is really a surprise for me, so I will continue to trade on TICKMILL’s platform, share my trading experience, and recommend more traders to register and invest in the platform. A thousand thanks!