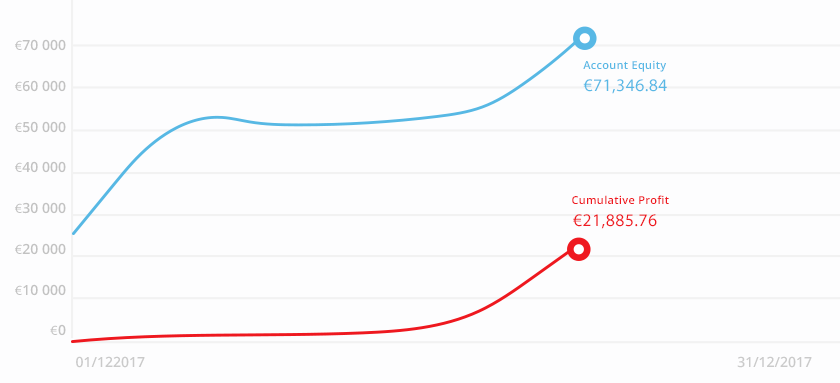

Massimo showed excellent account and risk management skills in December 2017 and got a €1,000 prize!

Read Massimo's interview and see his account statement to make your own success story

How long have you been trading?

I have been trading for about 2 years, after attending a seminar in Berlin with Mr Giovanni Cicivelli and dr. Hamed Esnaashari was the Berlin Trading Days. At this seminar I studied and learned the trading ABC (Newstrading, Chartformationen) step by step. Following the seminar, I gained further knowledge from successful traders such as Larry Williams, dr. Andrea Unger and Mr. Erdal Cene (online study, webinars, e-mail correspondence, phone calls, etc.).

How did you get involved in Forex trading?

The forex market is one of the most important trading places for me for two reasons: 1. Because of it has very high liquidity, 2. Because of its trading hours (the currency pairs will be streamed day and night from Monday until Friday).

What is your trading style?

My trading style consists of a portfolio of different setups, e.g. Combine news and chart formations and convert them into trades. A chart will give good indication what will happen and news story can tell me what's likely to happen next in the chart of a value. I also like to use POPGUN formations to trade outbreaks and it will also give indication of remaining conditions such as breakouts. It helps to precict the current trend of my trading setups so I can enter the trade. Another important factor is the intuition, which increases with the ever increasing experience and the number of trades.

Do you practice risk management?

Yes, I use risk management: usually I do not risk 1-2% of my current portfolio, but if I have a higher "probability" calculated, then I usually evaluate my risks.

What are some good habits smart traders develop?

I would call discipline and patience as the most important ones. The danger with "young" traders is the so-called Overtrading, one thinks, to have to act constantly, instead of waiting for really good chances and clear setups. As experience grows, you should learn to run your winnings and limit your losses, unfortunately too often we see the opposite behavior. Finally, I advise you to have no emotions when trading, either a trade is going in my direction or I usually set stop loss for this trade and keep waiting for my next chance. The opportunity-risk ratio should be at least 2: 1, if you want to have a statistical advantage in the long term.

Describe your best/most memorable trade (How much did you profit? What was the strategy? What pair?)

My best trades: Both were filled in December 2017: Once with the stock Overstock (OSTK). I invested there with a relatively high volume and honestly, for the first time with a lot of discipline and a lot of patience, "held out" a $ 20 USD move. This trade was primarily a Newstrade, with a timeframe of a few days to 3 months. On the other hand, I have had successful Bitcoin trades. My winnings have been from $ 7,000 up to about $ 18,000 traded.

What advice would you give to new traders?

To new traders I can give the following advice: First, you should have proper education, then I would start with "paper trading" on a demo account and exercise patience and discipline. For example: Daily schedule to to look back on trading day on markets, and to look for setups. If you have been successful with the paper trading for several months, you can switch to real trading account. Then you should be "sharp" and ready trade with real money.

Considering the current state of the market, what do you think are the news/events traders should keep an eye on?

Yes, on the one hand we have the political side (USA, Europe), but also, for example, the US labor market data, which by the way is released today (every 1st Friday of the month). Furthermore, one should also focus on the cryptocurrency market, as I believe that it will make its way into the international capital markets. I think it will happen this year. Real-time news tickers provide a foundation for getting a news overview across markets.

What are the most important things you look for in a Forex broker?

-

fair prices (lowest possible spreads)- a stable platform (see Brexit, US elections and similar events)- fast execution- wide range

At all points I can only recommend Tickmill.