Forex Trading Deposits & Withdrawals

Add, transfer or withdraw funds with ease, using the payment method that’s most convenient for you.

Control

your Wallet

Being able to make a deposit or withdrawal on your own terms is so important to your trading experience. At Primark we think it’s crucial that you’re able to manage your funds effectively. So, we provide a range of secure, instant and easy to use deposit and withdrawal options.

All deposits starting from 5,000 USD or equivalent, processed in one transaction by bank wire transfer, are included in our Zero Fees Policy. *

We will cover your transaction fees up to 100 USD or equivalent. Just email a copy of your bank statement or any other confirmation document for the transferred deposit to our Support Team. Within one calendar month after the deposit was made we will compensate your fee.

*We reserve the right to charge a maintenance fee where there is a lack of trading activity.

Deposit / Withdrawal Methods

Some options are only available to residents of certain countries. Also note that, when you request a withdrawal from your client area, the withdrawal will be in the base currency of your Wallet. E.g. If your Wallet is in USD, then your withdrawal will be processed in USD.

*By using the service, users agree to understand the inherent vulnerability to failure, delay, and/or disruption of online payment systems.

| Currencies | USD , EUR , GBP , ZAR |

|---|---|

| Min. Deposit | 100 |

| Min. Withdrawal | 25 |

| Commission | |

| On Deposit | None |

| On Withdrawal | None |

| Processing Time | |

| On Deposit | Within 1 Working Day |

| On Withdrawal | Within 1 Working Day |

| Currencies | EUR, USD, GBP |

|---|---|

| Min. Deposit | 100 |

| Min. Withdrawal | 25 |

| Commission | |

| On Deposit | None |

| On Withdrawal | None |

| Processing Time | |

| On Deposit | 24/7 Instant |

| On Withdrawal | Within 1 working day |

| Currencies | USD , EUR , GBP |

|---|---|

| Min. Deposit | 100 |

| Min. Withdrawal | 25 |

| Commission | |

| On Deposit | None |

| On Withdrawal | None |

| Processing Time | |

| On Deposit | Instant* |

| On Withdrawal | Within 1 Working Day |

| Currencies | USD , EUR , GBP |

|---|---|

| Min. Deposit | 100 |

| Min. Withdrawal | 25 |

| Commission | |

| On Deposit | None |

| On Withdrawal | None |

| Processing Time | |

| On Deposit | Instant* |

| On Withdrawal | Within 1 Working Day |

| Currencies | USD , EUR , GBP |

|---|---|

| Min. Deposit | 100 |

| Min. Withdrawal | 25 |

| Commission | |

| On Deposit | None |

| On Withdrawal | None |

| Processing Time | |

| On Deposit | Instant* |

| On Withdrawal | Within 1 Working Day |

| Currencies | USD , EUR , GBP |

|---|---|

| Min. Deposit | 100 EUR, USD, GBP |

| Min. Withdrawal | 25 |

| Commission | |

| On Deposit | None |

| On Withdrawal | None |

| Processing Time | |

| On Deposit | Instant* |

| On Withdrawal | Within 1 Working Day |

| Currencies | USD , IDR |

|---|---|

| Min. Deposit | $100 or 1,500,000 Rp |

| Min. Withdrawal | 25 |

| Commission | |

| On Deposit | None |

| On Withdrawal | None |

| Processing Time | |

| On Deposit | Instant* |

| On Withdrawal | Within 1 Working Day |

| Currencies | CNY |

|---|---|

| Min. Deposit | 700 ¥ or € / $ / £ 100 |

| Min. Withdrawal | 25 |

| Commission | |

| On Deposit | None |

| On Withdrawal | None |

| Processing Time | |

| On Deposit | Instant* |

| On Withdrawal | Within 1 Working Day |

| Currencies | USD , EUR |

|---|---|

| Min. Deposit | 100 |

| Min. Withdrawal | 25 |

| Commission | |

| On Deposit | None |

| On Withdrawal | None |

| Processing Time | |

| On Deposit | Instant* |

| On Withdrawal | Within 1 Working Day |

Deposit and Withdrawal Conditions

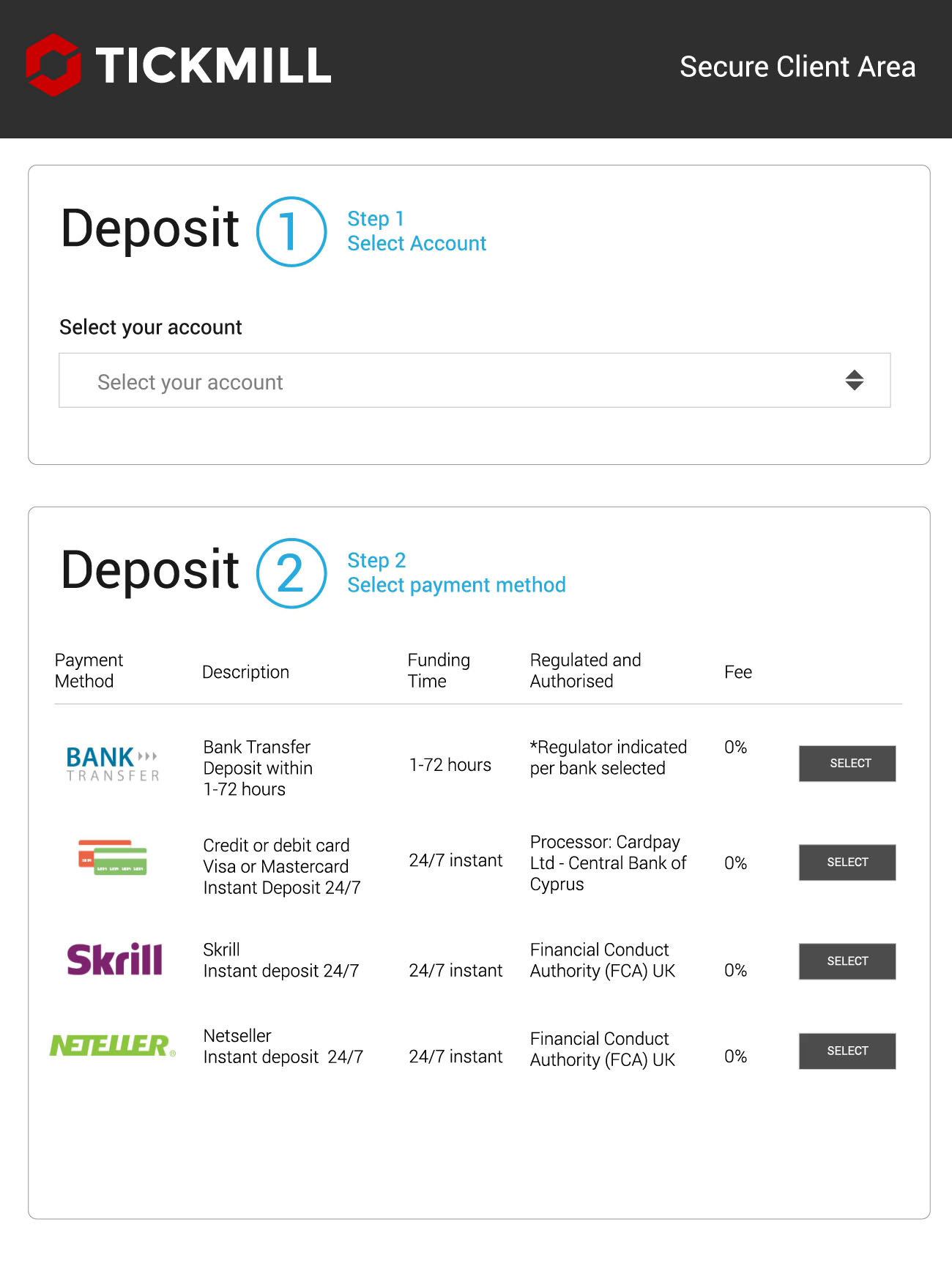

1. Select Deposit from the right-side panel against the chosen wallet, or alternatively select Deposit from the navigation tab.

2. Select Wallet – if you selected deposit from the Wallets screen this wallet will be selected by default, otherwise you can choose the desired wallet from the dropdown.

3. Select the Payment Method you would like to use to deposit into the wallet.

4. Specify the Amount you would like to deposit and select Submit, you will then proceed based on that payment method to finalise the transaction.

5. When the deposit has been received, you will be able to see the deposited amount against the wallet as well as details of the transaction from the Transactions History tab.

The minimum deposit is $100 for all account types. However, to get a VIP account, you have to reach a minimum balance of $50,000.

We do not accept any payments made via a third-party source.

You must only use payment methods that are under your name and lawfully belong to you.

We reserve the right to require proof from you at any time. Failure to comply with this, will result in your payment getting frozen or being refunded.

We reserve the right to apply a penalty processing fee if a third-party payment is made.

If you use a Credit/Debit Card to deposit, we may require scanned colour copies of both sides of your card to combat fraud. But, please do NOT send us any copies if we didn’t ask for them.

– Upon receiving our request and before sending any copies to us, please cover (black-out) all digits except the last 4 on the front side of your card for security purposes.

– Please also cover (black-out) the CVV code on the back of your card.

– All other details must be clear and visible.

– Your card must be signed, and your signature must be clear and readable.

Please be informed that we will NEVER ask you for any sensitive card details (such as your full card number, CVV code, 3D-secure code, PIN code, etc.). If you received a suspicious request for any sensitive details from an unclear source, please contact us immediately.

If your Credit/Debit Card deposit was unsuccessful, please try depositing again, while checking if:

– You have entered your card details correctly.

– You’re using a valid (not expired) card.

– You have sufficient funds on your card.

– If all of the above is fine, but your card deposit is still unsuccessful, it may mean that your issuing bank does not authorise your card to make the deposit. In that case, please use another card or any other payment method available in your trading account.

1. Select Transfer from the right-side panel against the chosen wallet, or alternatively select Transfer from the navigation tab.

2. Select Source of Funds – if you selected deposit from the Wallets screen this wallet will be selected by default, otherwise you can choose the desired wallet or trading account from the dropdown.

3. Select Destination for these funds to be transferred to – this can be between a trading account and wallet of the same currency, or from one wallet to another wallet of different currency.

4. Specify the Amount you would like to transfer and select Submit.

5. When the transfer has been made, you will be able to see the transferred amount against the wallet or trading account, as well as details of the transaction from the Transactions History tab.

As a general rule, we only process withdrawals back to the payment method you originally used for depositing.

For Credit Cards ONLY:

– If you use a Credit/Debit Card to deposit, we will always send the same total amount of withdrawals equal to your total deposits back to your card. Any remaining withdrawal amount which is above the deposited amount, will be processed to the payment method of your choice.

Example: If you deposited $100 by Credit/Debit Card, earned a profit of $1,000 and requested a withdrawal of $1,000, you will get $100 back to your card and the remaining $900 to the payment method of your choice.

Alternative Payment Methods:

– If you use a Credit/Debit Card and another method (e.g.: Skrill eWallet) to deposit, your withdrawal will first be processed back to your card and any remaining withdrawal amount will be sent back to the other method used (e.g.: Skrill eWallet).

Example: If you deposited $400 by Skrill and $100 by Credit/Debit Card, and requested a withdrawal of $300, you will get $100 back to your card and $200 to your eWallet.

We do NOT charge you any transfer fees for using our deposit and withdrawal methods, but intermediary banks or eWallets may do so, which is beyond our control.

We process payments only in EUR, GBP, ZAR and USD Payments made in a different currency will be automatically converted to the above-stated currencies, in which case your bank or eWallet may charge you a conversion fee, which is beyond our control.

1. Select Withdraw from the right-side panel against the chosen wallet, or alternatively select Withdrawal from the navigation tab.

2. Select Wallet – if you selected withdraw from the Wallets screen this wallet will be selected by default, otherwise you can choose the desired wallet from the dropdown.

3. Select the Payment Method you would like to use to withdraw from the wallet.

4. Specify the Amount you would like to withdraw and select Submit, you will then proceed based on that payment method to finalise the transaction.

5. When the withdrawal has been made, you will be able to see the withdrawn amount against the wallet as well as details of the transaction from the Transactions History tab.

Please familiarise yourself with our general Terms & Conditions found on our website. Our customer Support Team is available Monday – Friday 07:00 am – 20:00 pm GMT to assist you if you need any help with making your payments.

It’s also important to note that, should we become aware that you’re purposely abusing our payment methods, we reserve the right to close your account and also charge you all applicable transfer and refund fees incurred on our side.

START TRADING with Tickmill

It’s simple and fast to join!

REGISTER

Complete registration, Log in to your Client Area and upload the required documents.

CREATE AN ACCOUNT

Once your documents are approved, create a Live Trading account.

MAKE A DEPOSIT

Select a payment method, fund your trading account and start trading.